Chances are by now you have read or heard about Apple Card, a credit card designed and developed by Apple. It was one of the new services Apple announced in March during their Special Event. Alongside Apple News+, Apple Arcade, and Apple TV+. All of which are coming to Australia at some point during 2019.

But what is Apple Card? The purpose of this article is to provide a summary of what it is, how it works, and how it integrates with the iPhone and more. Plus answer perhaps the most important question of when will it be available in Australia.

What is Apple Card?

Apple Card is a credit card, but one that was designed and developed by Apple. And has been created to help us lead a healthier financial life.

To achieve this, Apple has been transparant about things like fees, built it with privacy and security in mind, and has integrated it heavily with the iPhone. This means it works with Apple Pay, Apple’s mobile payment service, but also enables features other banks simply cannot do.

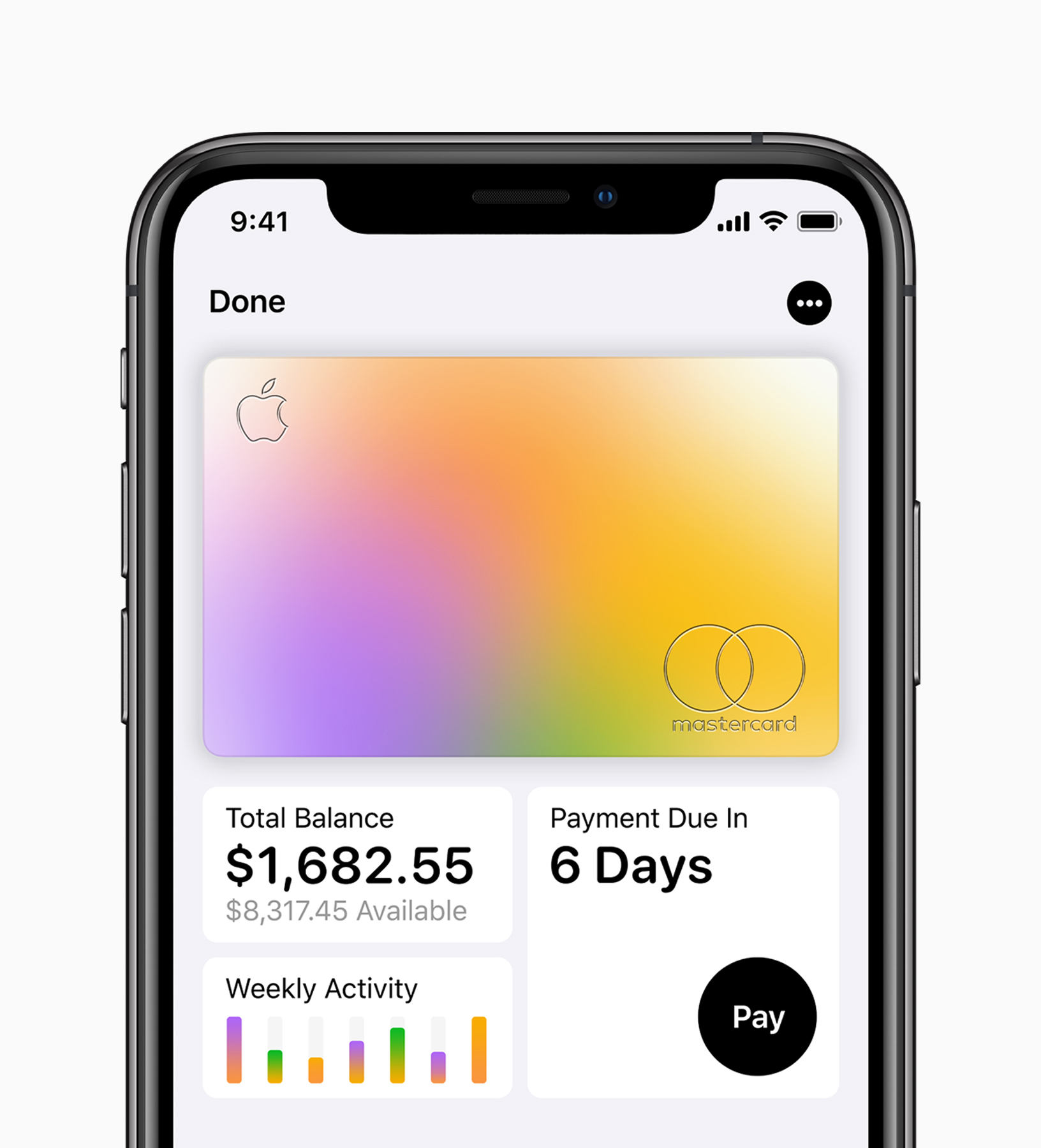

Firstly, Apple Card is built into the Wallet app on our iPhone. Essentially being a virtual card which we can use to make payments wirelessly with Apple Pay. In physical retail stores and apps, and on Apple Pay-enabled online stores. And can be used with our other linked devices such as Apple Watch, iPad, Mac, and so on. And because you need to authenticate with either Face ID or Touch ID, it means no one can use the card.

Being built into the Wallet app and using the power of the iPhone allows features only Apple can do. These include:

- Applying for one directly on iPhone

- Real-time transactions with the name and amount displayed

- Transactions categorised and colour-coded. For example, Food & Drinks

- Apple Maps and location integrated into each transaction. Displaying a map of where the transaction was made

- 24/7 support via Business Chat in the Messages app (iMessage)

- Manage payments including frequency, interest-rate, and more

All of these features are enabled using Machine Learning of our iPhones and not Apple. This means all information, such as transactions, are processed on our devices. Apple does not know what we spend, where we used the card or how much.

No Fees and Payments

Secondly, fees. Actually, what fees? Apple Card has no fees. No annual, cash?advance, over-the-limit, or late fees. Incredibly, there are even no international transaction fees.

It does have interest, but Apple is committed to providing some of the lowest interest rates in the market. The Wallet app also allows us to manage payments, make additional ones, and even get our balance to the point no interest is accruing.

Rewards

As with most other cards, Apple Card also rewards us for using it. Apple is calling this feature Daily Cash. Simply, we will be given a percentage of the amount spent back at the end of each day. It varies depending on where we have used our Apple Card, and method of payment.

Apple has stated Daily Cash will give back 3% on purchases made at Apple Retail, 2% with all purchases made with Apple Pay, and 1% with our physical Apple Card.

Physical Card

The intention of the Apple Card is to be used with Apple Pay. Meaning we don’t need a physical credit card. And the good news is 99% of Eftpos machines now support Apple Pay and is accepted in most major stores around Australia.

But what happens if Apple Pay is not supported, or if you’re shopping online and the merchant does not accept Apple Pay? To resolve this unlikely situation, Apple will be sending us a physical Apple Card. One that Apple has designed and as you would expect – Apple has gone all out.

The card is made from titanium and has no card number, CVV security code, expiration date, or even signature on the card. Because all of this is found in the Wallet App and means if you lose the card – no one can use it.

Goldman Sachs and Mastercard

While Apple could create Apple Card, it still requires a bank and processing network. This is because every credit card needs an issuing bank. Apple has teamed up with Goldman Sachs to issue the card and Mastercard for the payment network.

Release Date in Australia

Unfortunately, Apple has confirmed Apple Card will be, at this stage, available to eligible customers in the US only. And has since become available for signing up within the United States.

Apple has made no mention of an international release and has not confirmed if or when it will be out in Australia. Personally, I would even be surprised if the service expands to Australia next year in 2020. Nevertheless, there is some good news. Goldman Sachs has already said they are “exploring” international markets. And with Apple Pay being available in 99% of merchants around Australia, there is potential for us to be a suitable market.

When Apple does announce availability in Australia, this article will be updated. Until then, you can learn more at Apple’s US website.

2021 update: While Apple has so far made a number of announcements in 2020, an Apple Card release in Australia has not been one of them.